Unlocking Opportunities: How LiftMyScore Can Open Doors to Your Dreams

In a world where financial stability and creditworthiness play pivotal roles in achieving one’s dreams, LiftMyScore emerges as a beacon of hope. This innovative platform offers a powerful solution to individuals seeking to unlock opportunities and realize their aspirations. Join us as we delve into the intricacies of how LiftMyScore can transform your financial landscape and pave the way to a brighter future.

Introduction

In today’s fast-paced world, where opportunities often hinge on your financial standing, a low credit score can feel like an insurmountable barrier. Whether you dream of buying a new home, starting a business, or pursuing higher education, your credit score can either open doors or slam them shut. This is where LiftMyScore comes into play.

Understanding Credit Scores

What is a Credit Score?

Your credit score is a three-digit number that reflects your creditworthiness. It’s calculated based on your credit history, payment history, outstanding debts, and various other factors. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

Why Does it Matter?

A good credit score is crucial because it influences the terms and conditions you receive on loans, credit cards, and mortgages. A higher credit score means lower interest rates, better loan terms, and more favorable financial opportunities.

Challenges Faced Due to Low Credit Scores

Limited Access to Credit

Individuals with low credit scores often struggle to access credit. Traditional lenders are hesitant to extend loans or credit cards to those deemed high-risk borrowers.

Higher Interest Rates

Even if you manage to secure credit with a low score, you’ll likely face significantly higher interest rates. This can lead to paying thousands of dollars more over the life of a loan.

Housing and Employment Opportunities

A low credit score can also impact your ability to rent an apartment or secure certain job opportunities. Many landlords and employers check credit reports as part of their screening process.

LiftMyScore: A Game-Changer

How Does LiftMyScore Work?

LiftMyScore is a revolutionary platform designed to help individuals improve their credit scores efficiently. The platform analyzes your credit report, identifies areas for improvement, and provides actionable insights to boost your score.

Benefits of Using LiftMyScore

- Personalized Credit Improvement Plan

- Access to Expert Advice

- Monitoring and Alerts

- Faster Credit Score Improvement

Success Stories

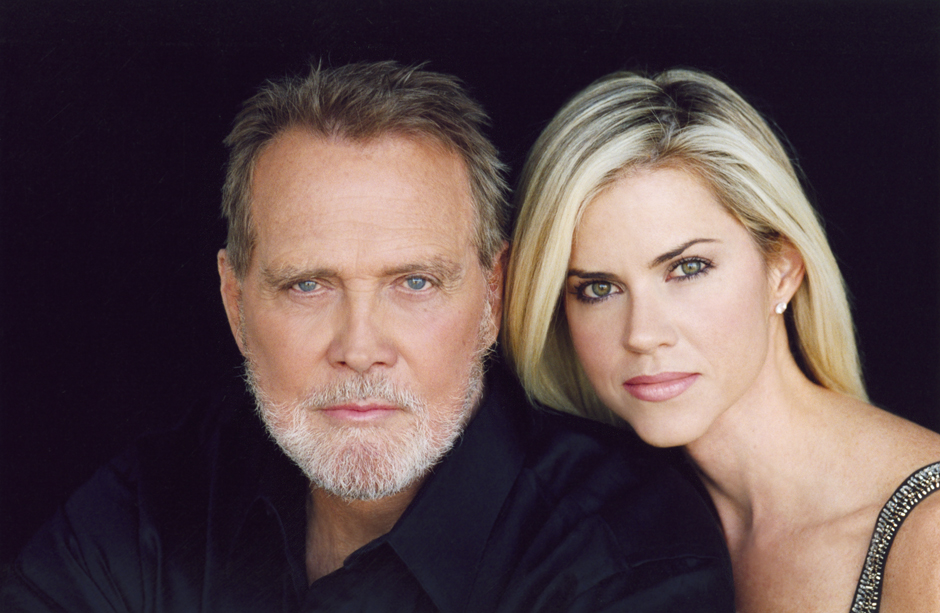

Real People, Real Results

Thousands of individuals have experienced life-changing improvements in their credit scores thanks to LiftMyScore. From securing their first homes to launching successful businesses, these success stories showcase the platform’s transformative impact.

Boosting Your Credit Score

To unlock opportunities and reach your dreams, it’s essential to improve your credit score. Here are some valuable tips and strategies to get you started:

- Pay bills on time

- Reduce credit card balances

- Monitor your credit report

- Dispute inaccuracies

- Avoid opening too many new accounts

Why Choose LiftMyScore Over Competitors?

LiftMyScore stands out in the crowded field of credit improvement services for several reasons:

- Proven track record of success

- Tailored solutions for every individual

- Cutting-edge technology

- Exceptional customer support

* * * Apple iPhone 15 Free: https://www.trap-d.biz/inquiry/files/il7j7b.php * * * hs=9b3ab211614c92bc295a6bdfe4fff835*

02nd Jun 20240vlpg6

* * * Apple iPhone 15 Free * * * hs=9b3ab211614c92bc295a6bdfe4fff835*

02nd Jun 2024zxhiw6